Triview Newsletter — September 2023

How the Triview Metro District is Funded

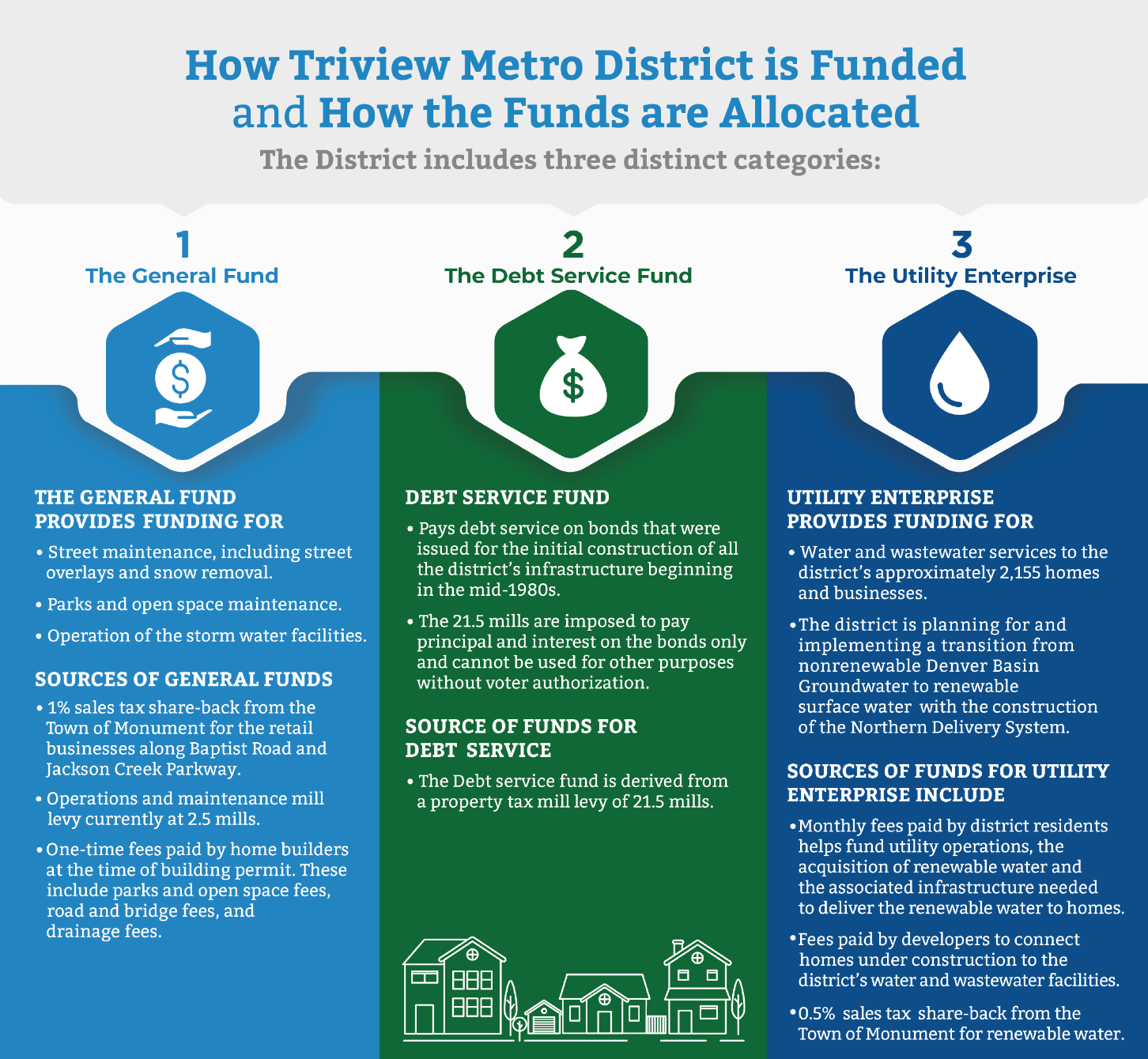

If you’re new to our community, you may have questions about what the Triview Metro District is and why you pay property taxes to the district. The following background information may help explain who we are and why we exist.

Triview was formed in 1985 as a special tax district that was created to provide municipal services where there were none. At the time, there were none of the amenities that exist today – roads, water, sewers, electricity, parks, trails and open spaces. The district issued bonds to pay for these, and the principal and interest on those bonds are paid for through a 24-mill property tax assessed on residential and commercial properties in the district. Of the 24 mills, 21.5 go toward debt service and 2.5 are for district operations and maintenance.

Today, the district is responsible for operating and maintaining these public assets and it generates revenue to pay for them by levying fees and charges, collecting taxes and issuing bonds. The district includes two distinct funds for operations: the General Fund and the Utility Enterprise.

About the General Fund

The General Fund provides all street maintenance (including street overlays and snow removal), parks and open space maintenance, and operates our stormwater facilities. The General Fund receives money from three primary sources:

- A 50% sales tax share-back agreement with the Town of Monument from retail businesses located on Baptist Road and Jackson Creek Parkway.

- A property tax mill levy of 2.5 mills.

- One-time fees charged at the time a building permit is issued for newly constructed homes and commercial buildings for parks and open space fees, road and bridge fees, and drainage fees.

The sales tax money is used to pay for the operation of the Streets and Parks departments along with the current 2.5 mills from the property tax assessment. The remaining 21.5 property tax mill levy is used to pay debt service payments on bonds that were issued for the initial construction of all of the district’s infrastructure beginning in the mid-1980s.

About the Utility Enterprise

The Utility Enterprise provides water and wastewater services to our approximately 2,155 homes and businesses (as of July 2023). In order to pay for utility operations, the district charges fees for both water and wastewater services. The Utility Enterprise also collects various water and wastewater fees on each home being built in the district. These fees are used to build major capital projects such as the Northern Delivery System, acquire water rights, and pay a portion of the debt service on revenue bonds that were issued to pay for the purchase of the district’s renewable water rights.

As Triview grows, both residential and commercial properties add value to Triview’s overall market value, which yields an increase in assessed valuation. When the district market value appreciates, it takes fewer mills to pay outstanding general obligation debt. This then enables the district to continue to reduce the mill levy, which will translate into lower taxes assessed on properties within the district’s boundaries.

2024 Budget Preview

The Triview Metro District staff and board are working hard to finalize the 2024 budget before the board reviews the final budget on Dec. 11, 2023. Once it’s approved, we will share the highlights of the 2024 budget and it will be posted to the website. In the meantime, following is a sneak preview of what’s to come.

The Triview Metro board of directors anticipates reducing the 2024 mill levy to 18 mills for Debt Service and 4 mills for Operations. This reduction assumes that Proposition HH does not pass and the district’s ability to meet its debt service requirements is not compromised. This reduction will save homeowners, on average, several hundred dollars per year in property taxes paid to the district. One of the reasons we have been able to continue to reduce the mills — which have dropped from 35 a few years ago to 24 now — is because of the growth in the district. New homes, the addition of commercial properties, and the appreciation of real estate values, have increased overall revenues. The district’s debt service obligation is relatively constant. Given this, the mill levy can be reduced because the amount of assessed valuation has increased which means the mill levy multiplier can be reduced, thereby yielding the same net revenue.

Proposition HH is one of two statewide ballot initiatives for this November 7. If it passes, it reduces the property tax rate; allows the state to retain and spend revenues that would otherwise be required to be refunded to residents under the Colorado Taxpayer’s Bill of Rights (TABOR), thus reducing TABOR refunds now and in the future; allocates revenue to local governments to make up lost tax revenues from the property tax rate reduction; creates a new increased cap on state revenue; and creates a limit on local government property tax revenues.

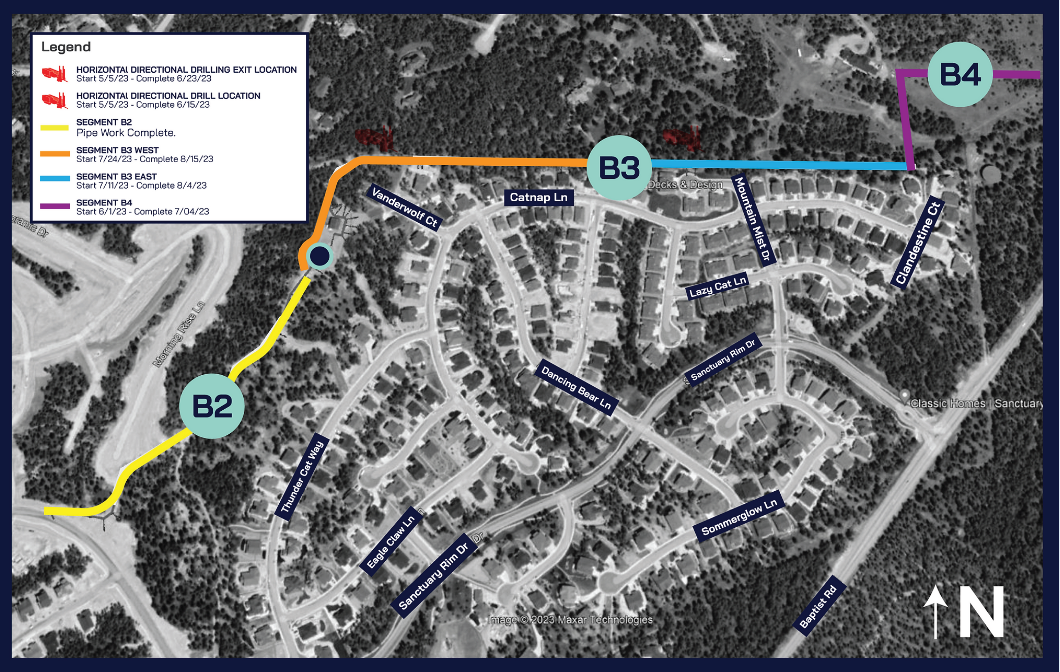

Northern Delivery System Update

Progress continues on the NDS, which when completed next summer, will bring renewable water to Triview and Forest Lakes customers. It will allow us to transition from our dependence on nonrenewable Denver Basin groundwater to creating our own water delivery system connecting our community to renewable water rights we have acquired.

We encourage you to check our contractor’s progress at https://www.triviewnds.com/.

By the end of this month, we expect restoration, landscaping and trail replacement to be complete on Section B 1, B-2, B-3. The road to the Triview water tank will be paved and restoration will be competed. Final mill and overlay of Roller Coaster Road and Old Northgate Road will be completed in mid-October.

Water continues to be a challenge for communities in our state, and our proactive steps mean we will maintain access to the water needed for our community to thrive. Beyond making life easier and cheaper, it also helps protect and enhance home values.